Getting in on The Act: How Will Central Bank Digital Currencies Change the Way We Make International Payments?

Posted on the 24th May 2024 by Hamish Anderson in Founders' blog, Business, Finance

For a few years now the central banks have observed the rise of cryptocurrencies and other digital assets like NFTs (non-fungible tokens) and stablecoins. Much has been written about digital assets and Central Bank Digital Currencies (CBDCs) are at the forefront of a revolution which is poised to reshape foreign exchange markets and alter the financial operations of UK-based SMEs and international payments users.

Continue readingNavigating the Waves: FX Risk Management for Small Businesses

Posted on the 19th April 2024 by Hamish Anderson in Founders' blog, SME blog, Business, Finance, Founder Insights

In an era where macroeconomic uncertainties seem to be the only constant, businesses venturing into the global marketplace face a multitude of challenges, not the least of which is managing foreign exchange (FX) risk. However, fear not! By adopting strategic FX risk management practices, businesses can shield their bottom lines from adverse movements and turn a potential threat into a competitive advantage. In this month’s blog, we explore some strategies to master the art of FX risk management.

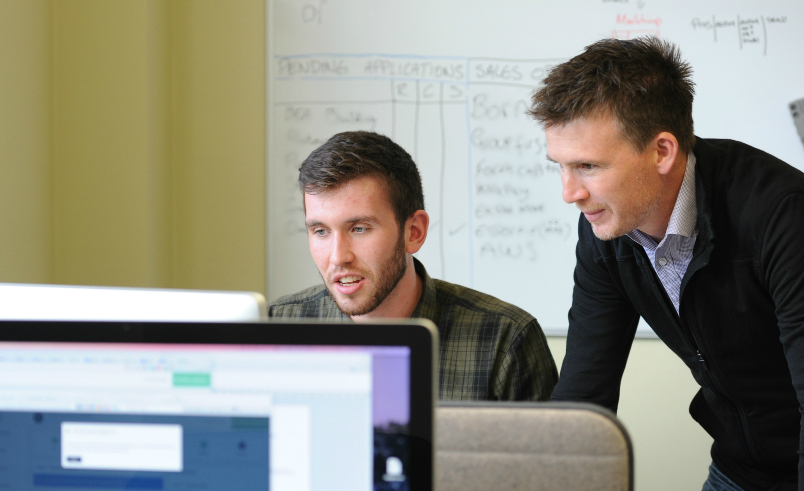

Continue readingUnraveling the Xero Effect: A Game-Changer for Accountants and Clients in the International Payments Realm

Posted on the 13th March 2024 by Hamish Anderson in Founders' blog, SME blog, Business, Finance, Founder Insights

For the UK's fintech sector and its users, the emergence in recent years of accountancy platforms like Xero has been nothing short of revolutionary. As a fintech company focused on navigating the intricacies of making payments across borders, we've witnessed firsthand (and experienced ourselves) the transformative impact Xero has had on our partners in the accountancy sector and their clients. In this blog we will delve into the core of this transformation, exploring how Xero has not just solved problems but has also redefined the financial landscape.

Continue readingRevolutionising the World of Numbers: How Fintech and Digital Tools have Transformed the Accountancy Profession

Posted on the 15th December 2023 by Hamish Anderson in Founders' blog, SME blog, Business, Finance, Founder Insights

The days of crunching numbers with a calculator and manually balancing books are fading into the past. Today, fintech and a plethora of digital tools have emerged as the driving force behind the transformation of the accountancy sector. In this blog post, we'll dive into the exciting ways in which fintech businesses like ours, and digital tools, have reshaped the world of accountancy.

Continue readingBank of England's Interest Rate Decision and Its Currency Market Impact

Posted on the 2nd November 2023 by Hamish Anderson in Founders' blog, General news, News, Business, Finance, Founder Insights

In today's global economy, the decisions made by central banks can have an impact on businesses worldwide. One such decision was made today by the Bank of England when it chose to hold interest rates steady at 5.25%. In this blog post, we will contemplate the Bank of England's decision, its influence on currency markets, and why businesses should pay close attention.

In today's global economy, the decisions made by central banks can have an impact on businesses worldwide. One such decision was made today by the Bank of England when it chose to hold interest rates steady at 5.25%. In this blog post, we will contemplate the Bank of England's decision, its influence on currency markets, and why businesses should pay close attention.

Navigating the Currency Landscape: What Scale-Up Businesses Need to Know

Posted on the 26th October 2023 by Hamish Anderson in Founders' blog, SME blog, Business, Finance, Founder Insights

Navigating the intricate global currency landscape is key for fostering growth and ensuring the success of your business. In this post, we will dive deeper into the essentials that scale-up businesses must grasp when it comes to currency management.

Continue readingThe Vital Connection: Paying Suppliers and Global Commerce

Posted on the 12th October 2023 by Hamish Anderson in Founders' blog, SME blog, Business, Finance, Founder Insights

UK businesses today are, by default, global. Regardless of sector, they operate in a fully interconnected world, compete with international companies, and must reach across borders to find customers, partners, and suppliers.

In order for all of this to function though, money must always be able to move across borders smoothly, reliably and at low cost.

Continue readingFintech Fights Fraud

Posted on the 21st September 2023 by Hamish Anderson in SME blog, Business, Founders' blog, Founder Insights

In the ever-evolving world of international payments, staying ahead of the curve means embracing innovation. However, as quickly as exciting new financial instruments and technologies emerge, so too do new challenges. One of the foremost concerns today is the heightened risk of fraud accompanying these cutting-edge tools. In this blog post, we'll delve into the world of these novel instruments, the real concerns they pose, and how fintech companies like Money Mover are tackling fraud head-on.

In the ever-evolving world of international payments, staying ahead of the curve means embracing innovation. However, as quickly as exciting new financial instruments and technologies emerge, so too do new challenges. One of the foremost concerns today is the heightened risk of fraud accompanying these cutting-edge tools. In this blog post, we'll delve into the world of these novel instruments, the real concerns they pose, and how fintech companies like Money Mover are tackling fraud head-on.

The Future of Cross-Border Payments: Bank of England Predicts a Monumental Surge

Posted on the 29th August 2023 by Hamish Anderson in SME blog, Business, Founders' blog, General news, Founder Insights

In the rapidly evolving landscape of international finance, the dynamics of cross-border payments play a pivotal role. As technology continues to redefine our world, the financial sector is no exception. The Bank of England's recent prediction of a significant increase in the value of cross-border payments from $150 trillion in 2017 to over $250 trillion in 2027 is not just a statistic; it's a testament to the power of innovation and global connectivity.

Continue readingKey Predictions for the Future of Fintech

Posted on the 10th August 2023 by Hamish Anderson in SME blog, Founders' blog, Founder Insights

If the last 10 years have seen remarkable transformations in the way that we all transact, invest, and manage our finances, what will the next ten bring?

“Everyone’s always asking me when Apple will come out with a cell phone. My answer is, ‘Probably never.’” Wrote David Pogue, the then technology correspondent, in the New York Times in 2006, beautifully demonstrating the folly of making public your predictions.

Continue readingReflecting on a Decade of Fintech Transformation

Posted on the 18th July 2023 by Hamish Anderson in Founders' blog, Business, Finance, Founder Insights

Last week I wrote about Money Mover’s journey over the last decade. At the time of founding the business, I was working at HSBC and it’s fair to say that the financial sector looked vastly different ten years ago.

Looking back, I am amazed by the rapid evolution and revolutionary changes we have witnessed in the fintech landscape in recent years.

Continue readingFrom Startup Struggles to Success: A Fintech Founder's Guide to Surviving 10 Years in the Industry

Posted on the 27th June 2023 by Hamish Anderson in Business, Founders' blog, Founder Insights

When Money Mover was born 10 years ago, the fintech industry was a vastly different place. Andrew, Simon and I dreamed of creating a business that would leverage the latest technology to improve the way that businesses made international payments. While we may not have achieved mythical unicorn status, our journey through the ever-changing fintech landscape has been a testament to resilience, determination, and a steadfast vision. As we celebrate our tenth year, we reflect on the invaluable lessons we've learned to survive and thrive in the tumultuous world of fintech.

Continue readingWhen Banks Go Bad

Posted on the 17th March 2023 by Hamish Anderson in Business, Founders' blog, Founder Insights

A week ago today, the first stories of big trouble at Silicon Valley Bank (SVB) were hitting the newsdesks. As befits the zeitgeist, rumours spread by social media of balance sheet inadequacies at America's 17th largest bank led to a rush to withdraw deposits and falling share prices. Would the issues affecting a specific institution lead to market contagion and put other banks at risk? Bankers and entrepreneurs went into the weekend with trepidation and concern.

Continue readingExploring the Impact of AI on International Payments

Posted on the 17th February 2023 by Hamish Anderson in Business, Founders' blog, Founder Insights

Interest in artificial intelligence (AI) has stepped up a notch in the last few months as ChatGPT has burst onto the scene. The natural language processing tool created by OpenAI has done what flying cars and hoverboards haven’t (yet). It’s here, it’s usable, and it’s poised to replace a large portion of the workforce. So I decided to take a look at how AI has already become an integral part of the global financial system and what the future holds. As the world becomes increasingly connected, the impact of AI on making international payments, managing fraud, and detecting money laundering will be significant.

Continue readingFilling in the gaps

Posted on the 21st May 2021 by Hamish Anderson in Founders' blog, SME blog, Business, Finance

In his latest blog, Hamish takes a look at the recent explosion in digital banking services, which is a good thing, and how the majority ignore the needs of international businesses, which is a bad thing.

Fortunately, there is a solution, and it's not even necessary to abandon your funky anodised debit card!

Continue readingNotes on a virus

Posted on the 30th June 2020 by Hamish Anderson in Founders' blog, Business, Finance

The impact of Covid-19 on Money Mover users

I thought it would be interesting to take a look at the changes in activity that we’ve observed amongst our SME (small and medium-sized enterprise) users over the last few months pre- and post-lockdown. While different countries acted at different times, lockdown in the UK started on 23 March 2020.

As Money Mover is still very much in a growth phase, we expect to add users, increase our volume and number of payments every month. Therefore our reference points are the prior month and the same month in previous years.

Continue readingMoney Mover drags payment tracking into the 21st Century

Posted on the 7th May 2020 by Hamish Anderson in Founders' blog, Finance, Money Mover News, News

I remember how exciting it was when I first encountered package tracking from one of the major parcel delivery firms. Knowing the exact location of my order on its journey to me felt like a big deal. Not only was it interesting to follow its progress but, knowing that it was on its way and when it would arrive somehow made you feel that you could get on with your life in the meantime.

In comparison, cross-border payment tracking has left a lot to be desired. However, the Money Mover Team has always been motivated by challenging convention, and our latest innovation is set to bring payment tracking bang up to date.

Continue readingA message from Money Mover

Posted on the 8th April 2020 by Hamish Anderson in Founders' blog

Life's normal rhythm has been disrupted lately, and it's far from business as usual for us and our users.

I wanted to let you know that the Money Mover Team is safe and well and the service is running normally. We're constantly monitoring the systems, banks and providers that we use and, so far, they are providing us with normal levels of service.

Continue readingMaking Sense of the Metro Bank Remedies Bungle

Posted on the 29th February 2020 by Hamish Anderson in Founders' blog, SME blog, Business, Finance, Founder Insights

Do you recall the controversy surrounding the £120m award to Metro Bank from the RBS Capability & Innovation Fund almost exactly a year ago? Eyebrows were raised at the time for several reasons. Firstly, observers and other participants in the process struggled to grasp how committing to opening additional bank branches in the north of England qualified as "developing more advanced business current account offerings", however worthy the intention. Secondly, throwing £120m at an institution which, days before, had owned up to a £900m hole in its balance sheet, had the most open-minded amongst us scratching our heads.

Continue readingWhy banks treat alternatives managers as second-class citizens

Posted on the 20th November 2019 by Hamish Anderson in Founders' blog, SME blog, Business, Finance, Founder Insights

Money Mover has now been an AIMA (Alternative Investment Management Association) partner for just over a year. I was chatting to delegates at its recent Spotlight on Raising Assets event in London and it occurred to me that I hadn’t ever explained why this partnership is so important to us and what we think it brings asset managers.

Continue readingHow crisis can provoke competition

Posted on the 11th October 2019 by Hamish Anderson in Founders' blog, SME blog, Finance

Part 1 - A banking crisis

Good things can sometimes result from the direst situations.

Let’s cast our minds back to September 2007. The financial world was in turmoil and there were queues of anxious customers outside the branches of the most respected names in high street banking.

Under the leadership of its controversial chief executive Fred 'the Shred' Goodwin, The Royal Bank of Scotland (RBS) had been acquiring competitors aggressively and was briefly the biggest bank in the world. It was the darling of the UK stock market and feted by government and industry alike as a poster child of achievement in the sector.

However, the 2008 financial crisis signalled a dramatic reversal in its fortunes.

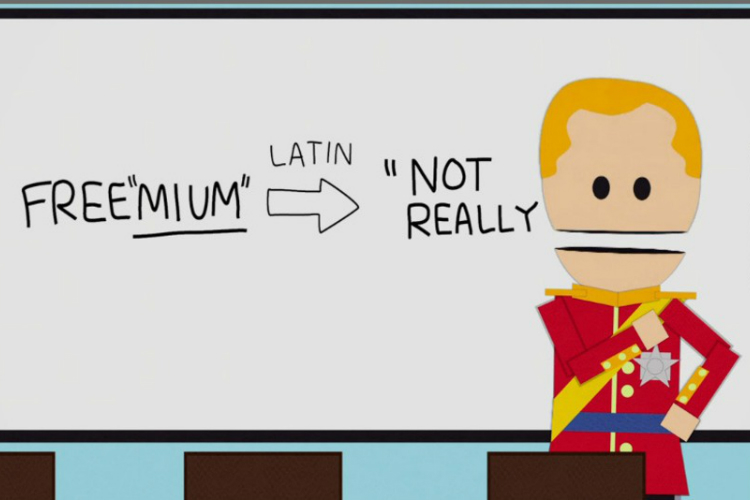

Continue readingIf you're not paying for it, you're the product

Posted on the 11th October 2018 by Hamish Anderson in Business, Founders' blog, Founder Insights

There is a growing number of international payments services out there, and new ones spring up all the time. It’s always been important to us that people understand why Money Mover couldn’t be more different from old school foreign exchange businesses with their boiler room sales people and low-tech service.

For us, transparency is all, and we’re committed to being honest about how we charge for our services, rather than subsidising costs with revenues generated from advertising, referral fees and cross-selling. Above all, we are vehemently opposed to monetising our customers’ financial records and transaction history.

Continue readingOpen Banking - what is it, and why do I care?

Posted on the 26th April 2018 by Hamish Anderson in Founders' blog, Business, Finance

By now you’ve probably heard about open banking. You may have even received a cryptic letter from your bank, asking for permission to do all sorts of things, and are wondering what all the fuss is about.

What is Open Banking?

As Money Mover users and supporters, you’ll probably agree with me that banking has been dominated by a small number of large players for too long.

Open banking seeks to change this by making it easier for to work with other banks and financial institutions, whether it’s to switch accounts or access new products and services.

The point of all this is to encourage innovation and improve competition in the financial sector.

Continue readingThe Future of Financial Data

Posted on the 27th February 2018 by Hamish Anderson in Founders' blog, Founder Insights

Photo L-R: Neil Garner (Thyngs), Ray Anderson (Bango), Emily Mackay (TAB), Hamish Anderson (Money Mover), Jeremy Sosabowski (AlgoDynamix)

Photo L-R: Neil Garner (Thyngs), Ray Anderson (Bango), Emily Mackay (TAB), Hamish Anderson (Money Mover), Jeremy Sosabowski (AlgoDynamix)

On Thursday 22nd February, I was invited by law firm Mills & Reeve and international technology community Cambridge Wireless to participate in a panel discussion. The panel, which was formed of CEOs from Cambridge-based financial technology (Fintech) firms was to debate the Future of Financial Data; specifically how recent regulatory changes would impact the way financial firms hold and use data.

Continue readingGBP since the rates rise - why raising interest rates doesn't always boost a currency

Posted on the 26th November 2017 by Hamish Anderson in Founders' blog, Finance

At midday on the 2nd of November the Bank of England raised its base lending rate for the first time in more than 10 years. The UK has been languishing in an unprecedented cycle of consecutive interest rate reductions, which ultimately had to reverse. Even so, the vote by the Monetary Policy Committee - the body which decides on how the UK’s interest rates should move - was divided, with 7 votes recommending the rise and two urging that things should remain the same. So what’s happened to exchange rates since the rise, and how did the comments of the Governor of the Bank of England -Mark Carney - influence the currency markets?

Continue readingBig in Japan - Money Mover attends Tokyo's Fintech Summit

Posted on the 31st October 2017 by Hamish Anderson in Founders' blog, Money Mover News, Founder Insights

Establishing relationships in new regions is challenging, and best achieved with help and guidance from local experts. Hamish Anderson, Money Mover's CEO, was therefore delighted to be asked to participate in a recent Trade Mission to Japan which was being run alongside Fin/Sum - Tokyo’s principal financial technology summit.

Continue readingWhy cryptocurrencies don’t add up for Money Mover and its customers

Posted on the 3rd October 2017 by Hamish Anderson in Founders' blog, Business, Finance, Founder Insights

I’ve just returned from a UK FinTech Trade Mission to Japan which coincided with the Tokyo FinTech Summit (Fin/Sum Tokyo).

A topic which came up frequently in formal presentations, panel sessions and discussions with delegates, was cryptocurrencies. No doubt this was because of the news that Japanese banks are setting up their own digital currency - J-Coin. Indeed, one Japanese FSA employee I chatted with was just about to head off to California on a mission to absorb all things cryptocurrency.

I had the chance to consider my position and thoughts on cryptocurrencies, particularly with regards to our business at Money Mover, and I thought I’d share these with you.

Continue readingWhat makes Money Mover different?

Posted on the 21st August 2017 in SME blog, Business, Founders' blog, Founder Insights

There are a lot of international payments services out there and it’s important to us that people understand why Money Mover couldn’t be more different from old school foreign exchange businesses with their boiler room sales people and low-tech service.

Continue readingThe Dangers for Sterling of Rolling the Dice

Posted on the 9th June 2017 by Hamish Anderson in SME blog, Business, Founders' blog, Founder Insights

As the exit polls predicted that the UK was on course for a hung Parliament, the pound dropped almost 2% against the US Dollar and the Euro in a matter of seconds.

Continue readingBrexit - the fall out begins

Posted on the 19th August 2016 by Hamish Anderson in Founders' blog

The formal Brexit process hasn’t even started, but we’re already feeling the impact of the referendum result. Sterling has depreciated by more than 10% against the major currencies and hit its lowest level against the USD for almost 30 years.

The formal Brexit process hasn’t even started, but we’re already feeling the impact of the referendum result. Sterling has depreciated by more than 10% against the major currencies and hit its lowest level against the USD for almost 30 years.

If it’s not transparent, it’s not fintech!

Posted on the 31st May 2016 by Hamish Anderson in Founders' blog

Whenever I’m asked to talk about Money Mover’s international payments platform, cutting costs is normally the last thing that I mention. Why? Because telling a small business that you’re going to charge them less is easy, but without knowledge and information it’s really hard for the SME to know whether they’re actually getting a better deal or not.

Continue readingInnovation and competition in financial technology - Fintech: promoting innovation

Posted on the 29th March 2016 by Hamish Anderson in Founders' blog

As part of a conference on “The Impact of Competition Powers on Financial Services” I took part in a panel discussion. While the conference’s theme was predominantly legal (it was hosted by Norton Rose Fulbright and attended mostly by lawyers) the theme of my panel was ‘Fintech: promoting innovation’.

Continue readingForecourts and Foreign Exchange: Why businesses want FX providers that are less like petrol stations and more like discount supermarkets

Posted on the 18th September 2015 by Hamish Anderson in Founders' blog

We all like to get the best possible price when we make a purchase. If we feel that we’re being overcharged or ripped off then, as consumers, we tend to vote with our feet.

Continue readingHow our £1m funding will help us better serve underserved SMEs

Posted on the 22nd July 2015 by Hamish Anderson in Founders' blog

Today we announced that we’ve secured £1m in investment from a group of financiers, entrepreneurs and technologists. The consortium includes former Towergate CEO and stakeholder in Funding Circle, Andy Homer, and Classic FM founder Sir Peter Michael.

Backing from such experienced private and institutional investors is a testament to the potential of Money Mover and signals the start of a new era in the company’s growth. The investment is critical if we’re truly to address the challenges that face small to medium sized businesses (SMEs) in the UK and beyond.

Continue readingWhy Cambridge?

Posted on the 29th April 2014 by Hamish Anderson in Founders' blog

I'm often asked why we set up Money Mover in Cambridge.

“Surely a financial services business should be in London?” people ask, “or in a country with lower taxes, or where the regulations aren’t so tough?”

There’s a basis of fact in all the above, but we considered all these things pretty carefully in the very earliest days of the company, and we tried to make choices which were true to the vision that we had for Money Mover.

Continue reading